USA Office Market Forecast 2017

Overview of USA Office Market

Overview of USA Office Market

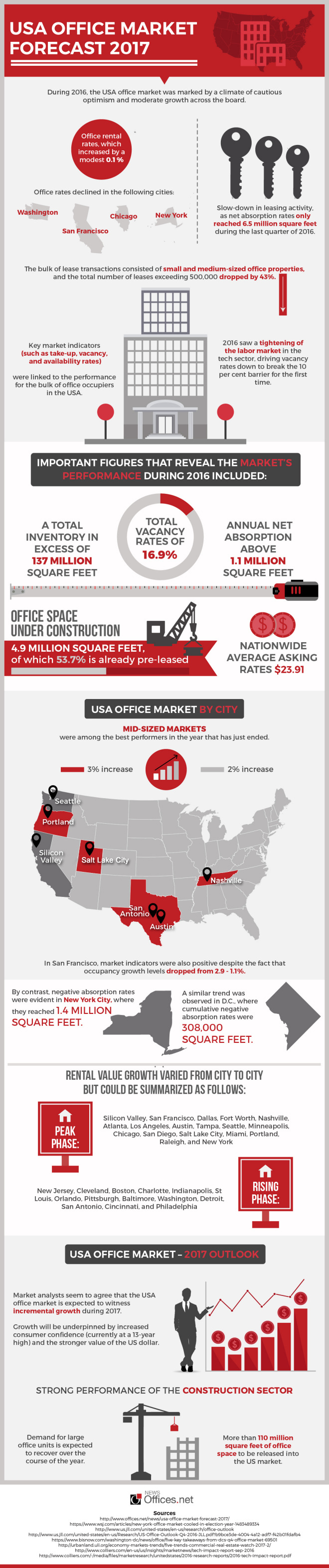

During 2016, the USA office market was marked by a climate of cautious optimism and moderate growth across the board. This was mostly evident in office rental rates, which increased by a modest 0.1 per cent or even declined in cities like Chicago, New York, Washington and San Francisco. This was coupled with a slow-down in leasing activity, as net absorption rates only reached 6.5 million square feet during the last quarter of 2016. The bulk of lease transactions consisted of small and medium-sized office properties, and the total number of leases exceeding 500,000 dropped by 43 per cent.

Key market indicators (such as take-up, vacancy, and availability rates) were linked to the performance of those industry sectors that make up for the bulk of office occupiers in the USA. 2016 saw a tightening of the labor market in the tech sector, driving vacancy rates down to break the 10 per cent barrier for the first time. This offset the relative stagnation in activity coming from occupiers involved in financial services, legal, and government.

Important figures that reveal the market’s performance during 2016 included:

– A total inventory in excess of 137 million square feet

– Total vacancy rates of 16.9 per cent

– Annual net absorption above 1.1 million square feet

– Nationwide average asking rates $23.91

– Office space under construction 4.9 million square feet, of which 53.7 per cent is already pre-leased

USA Office Market by City

Mid-sized markets were among the best performers in the year that has just ended. Portland, Nashville, Salt Lake City, and San Antonio were characterized by occupancy increases that averaged 3 per cent. In San Francisco, market indicators were also positive despite the fact that occupancy growth levels dropped from 2.9 to 1.1 per cent. Other regional office markets that did well included Austin, Silicon Valley, and Seattle. In these markets, occupancy growth averaged 2 per cent.

By contrast, negative absorption rates were evident in New York City, where they reached 1.4 million square feet. A similar trend was observed in D.C., where cumulative negative absorption rates were 308,000 square feet.

Rental value growth varied from city to city but could be summarized as follows:

– Peak phase: Silicon Valley, San Francisco, Dallas, Fort Worth, Nashville, Atlanta, Los Angeles, Austin, Tampa, Seattle, Minneapolis, Chicago, San Diego, Salt Lake City, Miami, Portland, Raleigh, and New York

– Rising phase: New Jersey, Cleveland, Boston, Charlotte, Indianapolis, St Louis, Orlando, Pittsburgh, Baltimore, Washington, Detroit, San Antonio, Cincinnati, and Philadelphia

USA Office Market – 2017 Outlook

Market analysts seem to agree that the USA office market is expected to witness incremental growth during 2017. Growth will be underpinned by increased consumer confidence (currently at a 13-year high) and the stronger value of the US dollar.

Demand for large office units is expected to recover over the course of the year, and this will be complemented by the strong performance of the construction sector given that over the next 12 months, more than 110 million square feet of office space to be released into the US market. There is however a risk of oversupply, although this may only affect gateway markets like Washington and New York. With regards of the office investment market, changes are expected to be minimal and demand for space in core markets will remain strong as long as short-term interest rates stay favorable.

Lastly, it is worth mentioning the impact that the new tech sector is expected to have on the US office market during 2017. In many of the nation’s gateway markets, new tech tenants are expected to overtake those in the financial and legal sectors in terms of absorption and take-up rates. Market forecasts from Colliers also suggest that in the medium term, this business sector could drive a surge in demand for large office properties.

Sources:

(1) https://www.wsj.com/articles/new-york-office-market-cooled-in-election-year-1483489334

(2) http://www.us.jll.com/united-states/en-us/research/office-outlook

(3) http://www.us.jll.com/united-states/en-us/Research/US-Office-Outlook-Q4-2016-JLL.pdf?b9bce3de-4004-4a12-adf7-f42b01fdafb4

(4) https://www.bisnow.com/washington-dc/news/office/five-key-takeaways-from-dcs-q4-office-market-69501

(5) http://urbanland.uli.org/economy-markets-trends/five-trends-commercial-real-estate-watch-2017-2/

(6) http://www.colliers.com/en-us/us/insights/marketnews/tech-impact-report-sep-2016

and http://www.colliers.com/-/media/files/marketresearch/unitedstates/2016-research-reports/2016-tech-impact-report.pdf